Bunq, a Dutch digital bank is helming the regulatory area as it seeks to obtain a banking license from U.K. financial regulators by late this year or early next year.

This endeavor follows its forced exit from the U.K. market in late 2020 due to Brexit implications. Despite the challenges posed by Brexit, Bunq remains determined to reenter the U.K. market, recognizing the potential of catering to the sizable population of British digital nomads.

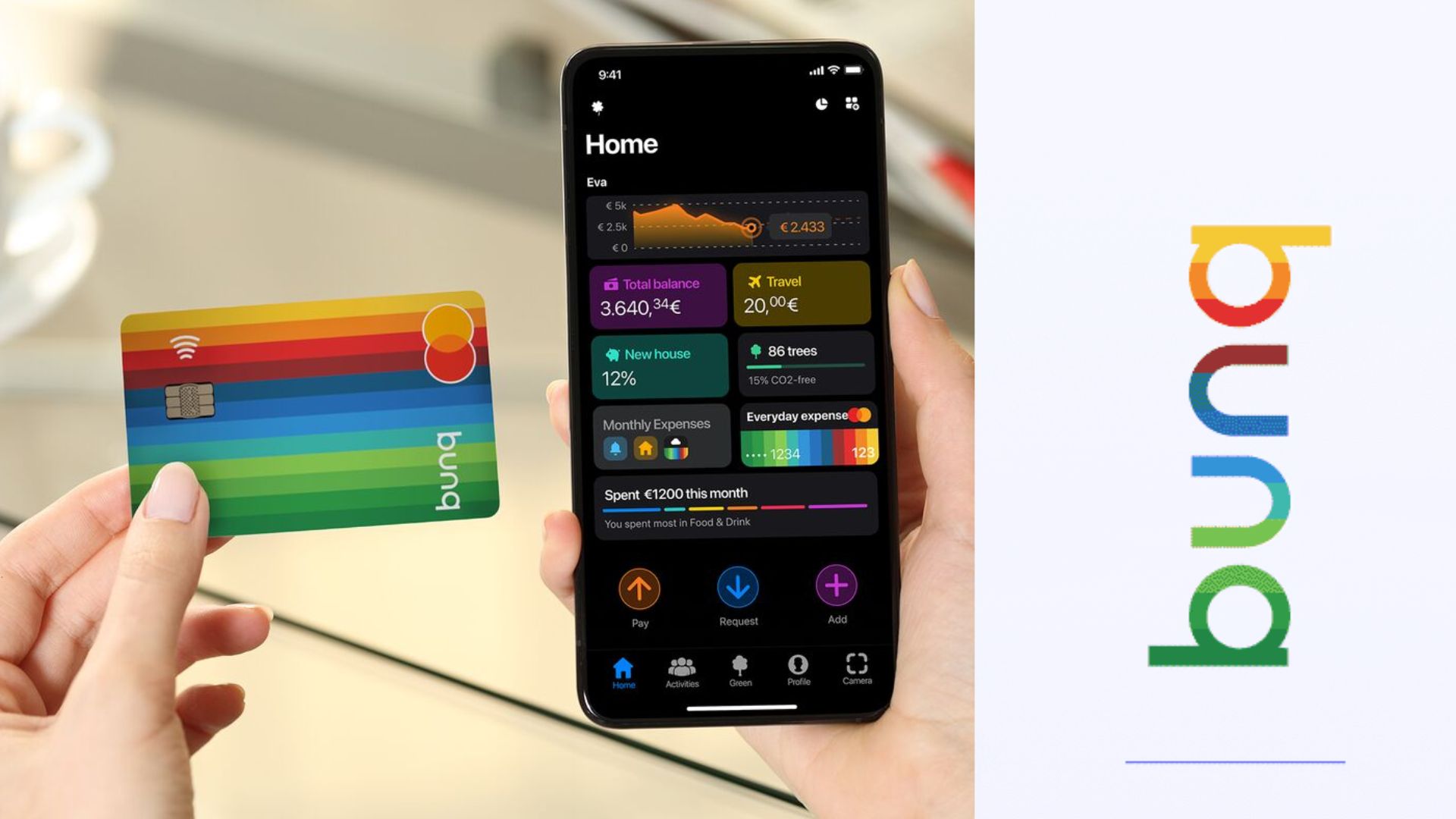

Bunq pursues UK banking license post-Brexit, eyes US expansion, despite regulatory complexities.

The firm submitted an application for an electronic money institution license with the Financial Conduct Authority, aiming to tap into the underserved U.K. market.

However, securing a banking license entails more complexities, as it grants permission to offer loans, unlike an e-money license.

Bunq’s CEO, Ali Niknam, remains hopeful, citing ongoing dialogue with regulators and a responsive approach from the U.K. regulator.

Meanwhile, Bunq continues its growth trajectory in Europe, boasting 12.5 million users and 8 billion euros in deposits, with a recent milestone of achieving profitability in 2023.

The company also has its sights set on expansion into the United States, having initiated the process of obtaining a U.S. federal bank charter in April 2023.