Boeing is confronting substantial hurdles, as articulated by CFO Brian West. The company anticipates continued cash depletion throughout the year, coupled with stagnant aircraft deliveries in the second quarter.

West’s prior projection of a low single-digit billion-dollar free cash flow now yields to mounting expenses attributed to production obstacles.

In the first quarter alone, Boeing depleted nearly $4 billion in cash, with a similar or potentially exacerbated outcome forecasted for the second quarter. However, West holds onto optimism for cash generation in the latter half of 2024.

The first quarter witnessed the lowest delivery rates since the onset of the pandemic, with considerable revenue streams tied to plane handovers.

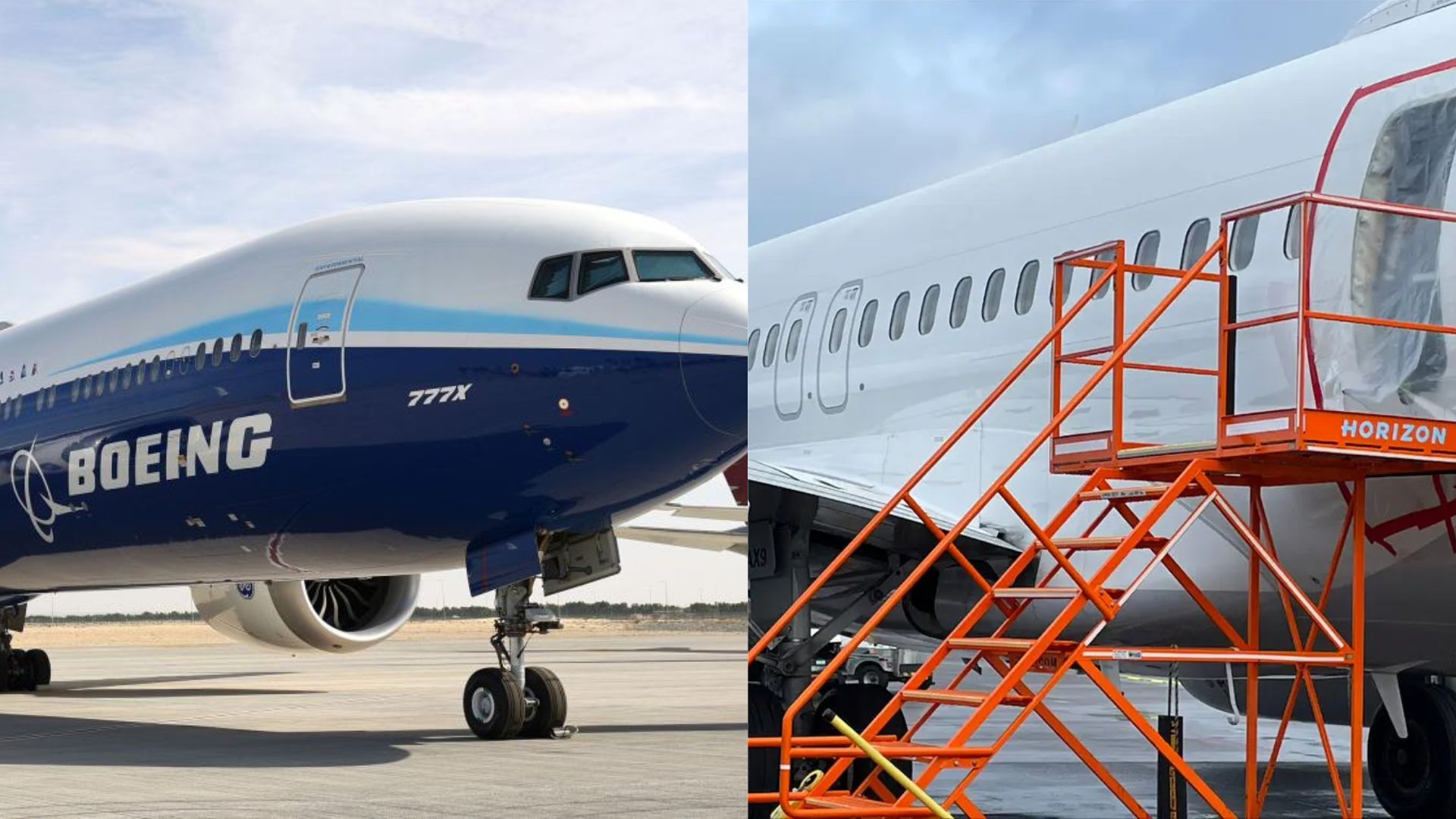

Boeing grapples with cash burn, delivery setbacks, and production challenges while helming leadership changes.

West candidly acknowledges customer frustrations stemming from supply chain intricacies, emphasizing Boeing’s commitment to rectifying production stability and enhancing quality.

Despite these assurances, Boeing’s stock plummeted by over 7%, impacting the Dow Jones Industrial Average.

The impending departure of CEO Dave Calhoun has precipitated leadership transitions within the commercial airplane unit amidst mounting customer grievances over delayed deliveries and operational disruptions.

Recent incidents, notably the 737 Max 9 door plug incident, have intensified regulatory scrutiny. Boeing is diligently working to rebuild trust, evidenced by its forthcoming meeting with the Federal Aviation Administration to present a comprehensive quality control enhancement plan.

Additionally, challenges persist, such as the temporary halt on 737 Max deliveries to China for battery assessments and a new FAA investigation into 787 Dreamliner inspections following employee misconduct.

Parts shortages further impede Dreamliner deliveries, prompting operational adjustments by major carriers like American Airlines, United Airlines, and Southwest Airlines. These collective challenges underscore Boeing’s current operational complexities and the imperative for swift, effective solutions.