Banking has experienced a major change due to the rise of financial technology startups, which are reshaping how people access and use financial services. These young companies, with their innovative approaches and use of technology, have challenged the traditional banking system and introduced fresh methods for managing money.

The impact is clear in how financial services are delivered, making them more accessible, affordable, and user-friendly for a large portion of the population. Technology has made it easier for millions of people who were previously left out of the banking system to participate in formal financial activities.

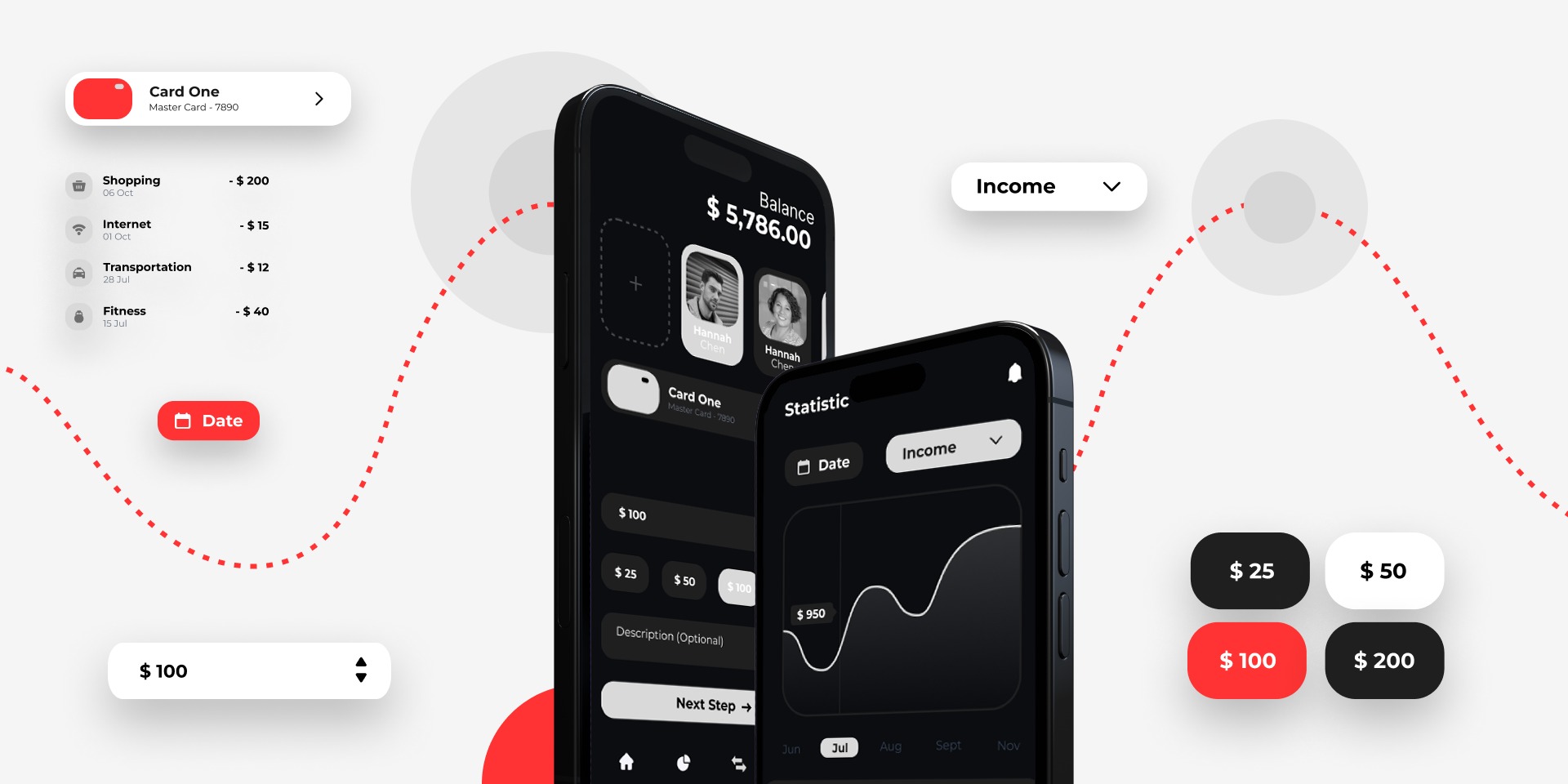

Digital banking brings financial services to millions previously left out (Photo: Shutterstock)

Startups are offering solutions that allow customers to open accounts digitally, transfer funds quickly, and access loans without visiting a physical branch. The convenience provided by these startups is changing the expectations customers have for banks and financial services.

Innovations Boost Financial Inclusion

One of the major effects these fintech firms have brought is expanding financial inclusion. Many individuals and small businesses in rural or underserved urban areas have long struggled to access banking services due to lack of infrastructure or documentation.

Fintech companies now provide platforms that require minimal paperwork and operate largely through mobile phones. This change has enabled a huge number of previously unbanked Nigerians to participate in the financial system, improving their economic opportunities.

Digital wallets, payment apps, and lending platforms are some examples where fintech startups are leading the charge. These services help users avoid the hassles of carrying cash or relying on informal lending sources.

Also, the speed at which loans can be disbursed and repayments managed through technology has encouraged more entrepreneurship and consumption, stimulating economic activities.

How Technology Drives Efficiency

Banks have traditionally been burdened with slow processes and high operational costs. The entry of fintech startups has forced the sector to adopt new technologies such as artificial intelligence, blockchain, and cloud computing to keep up.

These tools enable automation of many banking tasks, reducing errors and speeding up service delivery. For example, AI-powered chatbots now handle customer inquiries around the clock, providing immediate responses without the need for human intervention.

Blockchain technology offers a secure way to record transactions, which increases trust among users. Cloud services have also allowed banks and startups alike to scale their operations flexibly without heavy investment in physical infrastructure.

Partnerships Between Startups and Traditional Banks

Instead of working completely apart, many fintech startups collaborate with established banks to create hybrid models that benefit from the strengths of both.

Banks bring experience, regulatory knowledge, and large customer bases, while startups contribute agility, innovative ideas, and technical skills. These partnerships help traditional banks modernize their offerings and reach new customers through digital channels.

For instance, some banks have integrated fintech apps into their services to offer digital lending and payment solutions. Others use startup platforms to enhance their customer onboarding processes or provide personalized financial advice using data analytics. Such collaborations reduce the gap between old and new banking systems and create a more integrated financial ecosystem.

Challenges Faced by Fintech Startups

Despite the rapid growth, fintech startups encounter several hurdles in their journey. Regulatory compliance remains a major concern as these companies must operate within strict frameworks designed to protect customers and maintain financial stability. Sometimes, regulations lag behind technology, causing confusion or limiting the speed of innovation.

Mobile apps are making loans and payments faster and easier than ever (Photo: Alamy)

Additionally, cybersecurity risks pose a constant threat to both startups and their users. Protecting sensitive data and preventing fraud requires continuous investments in security infrastructure and expertise. Startups also face the challenge of gaining the trust of customers who may be wary of new digital financial services compared to traditional banks.

The Road Ahead for Fintech in Banking

The future points towards deeper integration of fintech solutions within mainstream banking. As technology improves and regulations adapt, the range of services fintech startups offer will expand further. Areas like wealth management, insurance, and cross-border payments are already attracting fintech attention.

The increasing smartphone penetration and internet connectivity will allow these startups to reach even more people, including those in remote locations. With the government and regulators showing interest in fostering innovation while protecting consumers, the environment for fintech startups appears promising.

Digital financial services are expected to become the norm, with customers demanding faster, simpler, and more personalized banking experiences. The competition between traditional banks and fintech firms will likely lead to higher standards of service across the board. The role of fintech startups in transforming the banking sector will continue to be critical in shaping how money is managed and moved in the country.

Financial technology startups are not merely supplementing existing banks but are redefining the financial services industry. Through innovation, partnerships, and addressing gaps in financial access, they are influencing a change that benefits millions by providing more efficient, inclusive, and customer-centric banking options.