Across the past decade, the global startup space has experienced a surge in high-value companies reaching billion-dollar valuations, with a remarkable number of these businesses coming out of South Asia.

Among the countries making a bold mark, one nation has witnessed an impressive emergence of innovative tech-driven enterprises, especially within its urban business hubs. This growth has not occurred by chance.

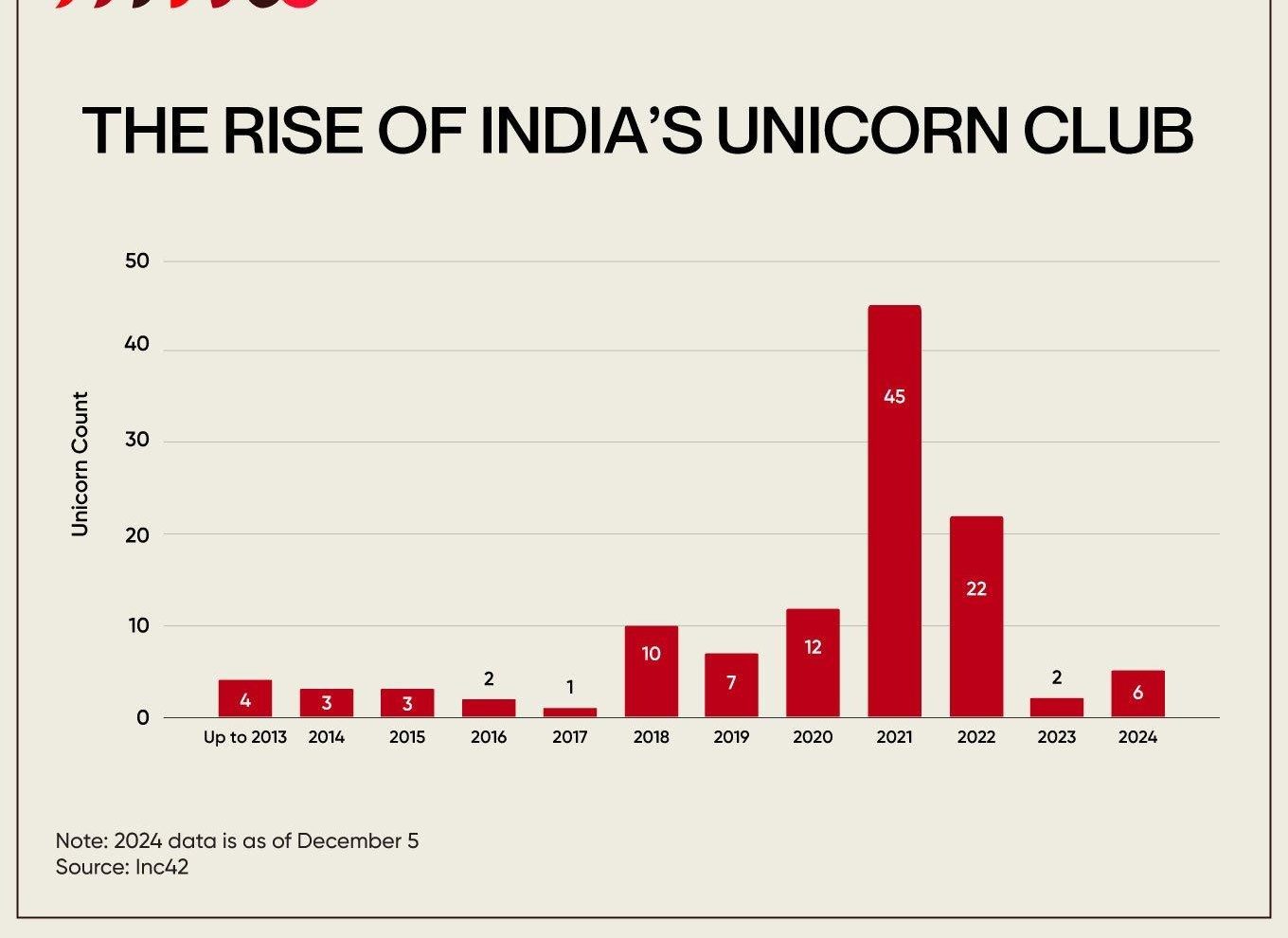

A combination of policy support, increased investor interest, and a vibrant young population has fueled the expansion of startups turning into unicorns companies valued at over $1 billion.

Young founders brainstorm at a co-working space in Bengaluru (Photo: Getty Images)

The progress being made reflects changing priorities, economic ambitions, and the strong appetite for digital transformation in sectors like fintech, e-commerce, education technology, and healthcare services.

The presence of a strong technology foundation combined with access to mobile data and a growing internet user base has laid the groundwork for this development. Young entrepreneurs, many of whom studied abroad or worked in global firms, have returned with fresh ideas, leading teams that understand both local markets and international trends.

This blend of global exposure and local relevance has allowed these companies to scale with speed. Several of them have achieved valuations that match or exceed their counterparts elsewhere, gaining attention from venture capitalists and private equity investors around the globe.

Foundation of a Rapidly Growing Ecosystem

The startup climate began evolving as early as the mid-2000s, but it was after 2015 that momentum began to build rapidly. A key factor was the development of digital infrastructure, particularly payment systems and logistics networks.

Digital India initiatives opened doors for easier access to government services, which in turn encouraged more business owners to formalise their operations. With the introduction of faster and more reliable broadband coverage, especially in second-tier cities, smaller enterprises started reaching customers across state boundaries.

Access to funding also played a critical role. Angel investors, venture capital funds, and even traditional business houses saw potential in investing early in promising ideas.

This financial backing allowed startups to test their products, scale operations, and attract more customers without waiting for profitability in the short term. With a more risk-tolerant investment culture forming, founders were encouraged to think bigger and pursue ideas that previously would have been considered too ambitious.

Major Sectors Powering the Boom

Digital payments and fintech applications have stood out as main drivers in the rise of these billion-dollar ventures. With a large population previously outside formal banking structures, fintech firms tapped into this gap by offering easy-to-use mobile platforms for payments, loans, and savings. By simplifying the customer experience, these startups expanded financial inclusion and created loyal user bases.

E-commerce also gained ground at a remarkable rate. As more consumers gained access to smartphones and mobile data, shopping habits shifted from physical stores to online platforms.

Startups offering quick delivery, wide product selections, and regional language support became household names. These services grew even faster when health restrictions during the pandemic made online shopping a necessity.

Education technology, or edtech, experienced a breakthrough moment as schools shut down and parents turned to digital tools for learning continuity. Companies offering live classes, doubt-clearing sessions, and skill development courses saw a spike in demand.

Even after schools reopened, many learners continued using these platforms for supplementary education. Similarly, healthtech solutions offering remote consultations, diagnostics, and medicine delivery built strong customer trust.

Investor Confidence and Strategic Partnerships

International investors have shown strong belief in the potential of these companies. Major funds from the United States, Japan, and Southeast Asia have participated in multiple funding rounds.

Their involvement has not only brought in capital but also introduced global best practices in operations, compliance, and scaling techniques. Strategic partnerships with larger global firms also helped many startups break into foreign markets.

One reason for this level of attention is the size of the customer base. With over a billion people and an expanding middle class, the demand for affordable and accessible services is high. Investors view this as a rare opportunity to back companies that can serve large numbers of users at low cost and still generate strong returns once operations become streamlined.

Role of Government and Regulatory Adjustments

Policies encouraging entrepreneurship have made a difference. Tax benefits, simplified registration procedures, and startup incubators have helped reduce barriers for first-time founders. Programs like Startup India provided recognition and credibility to new ventures, which made it easier to attract both customers and investors.

Although regulation has posed occasional challenges, adjustments have often followed based on feedback from industry stakeholders. Whether it involved easing restrictions on foreign direct investment or clarifying taxation policies for digital businesses, efforts have been made to balance oversight with growth support.

Cultural Mindset and Youth Involvement

One of the most underrated elements driving this trend is the change in mindset among young professionals. Unlike past generations that prioritised government jobs or traditional business careers, many graduates now see entrepreneurship as a preferred path. The influence of success stories from within the country has inspired students and early-career professionals to pursue their ideas with determination.

Tech-focused education, online learning resources, and coding bootcamps have also empowered more young people to build software products or develop tech-enabled solutions. Founders in their twenties and early thirties now lead some of the most valuable ventures, demonstrating what is possible when youth ambition meets structured support.

Challenges Faced by Unicorn Startups

Despite the momentum, these companies are not free from difficulties. Scaling up rapidly brings pressure on operations, customer service, and employee retention. Some ventures have faced criticism for burning too much capital without clear profitability paths. Others struggle to maintain consistent quality as they expand to new regions.

Tougher regulatory scrutiny has also come into play in areas like data privacy, cybersecurity, and cross-border transactions. These rules require startups to invest more in legal and compliance departments, which sometimes slows down product development. Also, competition from global players entering the market has increased, pushing local startups to become more agile and responsive to change.

Emerging Trends and Future Expectations

As consumer needs continue to grow, many unicorns are branching into new verticals. A fintech company may introduce insurance services. An e-commerce platform might launch its own product line. By offering multiple services within one app, startups aim to increase user retention and monetise more effectively.

A startup team celebrates crossing the billion-dollar valuation mark (Photo: Twitter)

There is also growing interest in sustainable technology, especially in areas like electric vehicles, clean energy, and waste management. Investors are starting to support ventures that provide eco-friendly alternatives, driven both by consumer demand and long-term cost advantages.

Artificial intelligence and automation are becoming central to product offerings. Whether in chat support, logistics planning, or personalised recommendations, startups are integrating advanced technologies to boost efficiency and user experience. These tools also help in gaining insights from user behaviour, allowing businesses to make smarter decisions based on real-time data.

Long-Term Outlook for Startup Growth

The momentum seen so far shows no sign of slowing down. With continued urbanisation, digital adoption, and policy backing, the conditions remain favourable for new unicorns to emerge. Even in periods of global uncertainty, startups that address basic needs such as health, education, finance, and retail are likely to stay resilient.

Established unicorns may also play a role in creating the next generation of successful startups. As former employees branch out and launch their own ventures, knowledge and networks get passed down, strengthening the entire business environment. Over time, this cycle of growth could lead to a broader impact on employment, innovation, and international trade opportunities.

A country that was once known more for its service outsourcing sector has now become a home for product innovation and original business models. The transformation witnessed in its startup system has been built on a combination of talent, technology, trust, and timing.

While many challenges still lie ahead, the rise of unicorn startups has already reshaped how people work, shop, learn, and manage their finances. And as digital tools become even more embedded in daily life, this growth story may continue to expand, both within its borders and far beyond.