Pockets of technological advancements across Asia have brought about changes in how people handle money, and one of the most determined campaigns to reduce physical cash usage has been ongoing in South Asia.

Over the last few years, efforts to reduce the dependence on paper currency have moved steadily, influenced by digital policy directions, new innovations in financial services, and increasing smartphone usage.

Shopkeeper scans a QR code from a roadside fruit stall in Delhi (Photo: Shutterstock)

With more citizens owning mobile devices and gaining access to data services, the process of moving towards a system dominated by digital payments has taken stronger roots.

The change did not occur overnight. A combination of events including government reforms, the introduction of digital wallets, as well as rapid support from fintech companies have supported this transformation.

Policymakers have maintained that reducing reliance on cash brings benefits such as increased transparency, easier monitoring of tax revenue, and reduction in illicit transactions. As a result, digital payment methods have become more accessible and have entered daily routines, from paying utility bills to buying vegetables at roadside stalls.

Role of Government Decisions and Policy Actions

One of the boldest moves in this direction came through currency reform, particularly a moment in 2016 when high-value banknotes were taken out of circulation. That event forced both merchants and consumers to look for alternative payment methods.

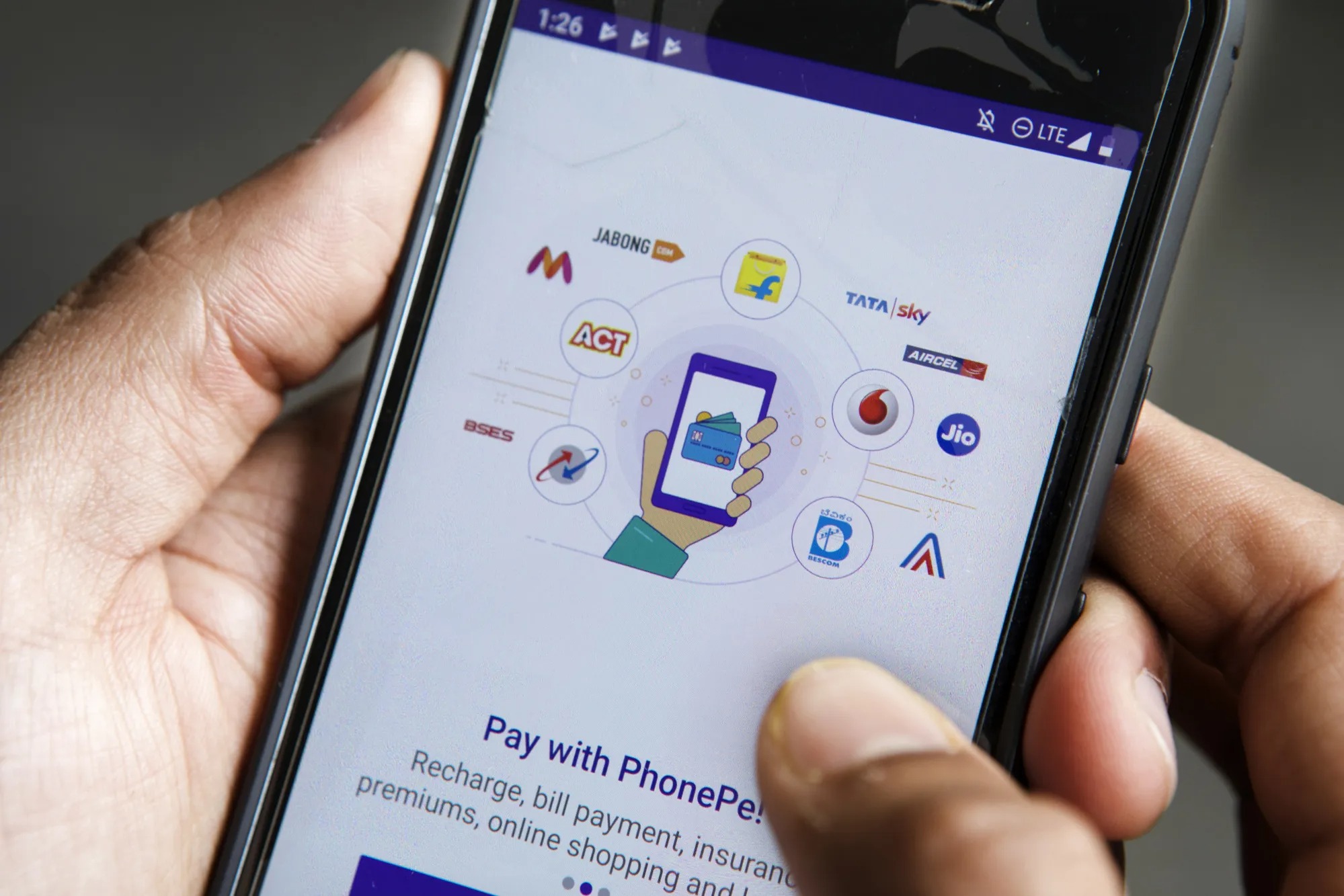

In response, mobile-based payment platforms experienced sharp increases in user registration and activity. Payment apps became household names, and within months, small businesses began accepting QR codes at a rapid rate.

Support did not end at currency reform. Authorities introduced the Unified Payments Interface, known commonly by its abbreviation, which allowed bank-to-bank transactions in real time through mobile phones. By simplifying how people send and receive money, the country reduced the need to handle banknotes.

Policymakers followed up by encouraging citizens to open digital bank accounts and linking them to their identity cards. This step allowed even low-income earners in rural areas to participate in financial services without stepping into a bank branch.

Technology Companies and Their Influence

Private sector input has also played a big part in this direction. From early days, tech firms created applications and tools that enabled fast and secure transactions. Their solutions included everything from tap-to-pay systems to peer-to-peer transfers through mobile contacts.

Many of these services offered cash-back rewards and discounts for using digital payments, thereby encouraging a culture that prioritised convenience over cash.

More importantly, many of these tools were designed with the local environment in mind. Developers ensured that even phones with basic functions could run payment applications.

They also introduced multiple local language options, which made adoption easier in a linguistically diverse country. By creating platforms that work even on low internet bandwidth, the tech companies succeeded in winning over users in areas with limited connectivity.

Consumers Embracing New Methods

Daily users have now adjusted their routines to fit into the changing financial environment. Whether ordering food, booking transport, or shopping online, digital payments have become common.

Even among street vendors and small kiosk owners, the adoption of QR-based payments is widespread. The idea of paying with a phone rather than coins or notes no longer feels unusual.

In public transportation systems, several cities have introduced cards or mobile ticketing systems that remove the need for loose change. Meanwhile, major utility services allow bill payments through digital wallets, banks’ mobile applications, and third-party platforms.

As digital literacy grows among the population, more people become comfortable with features like setting spending limits or tracking expenses digitally.

Benefits to the Economy and Financial Monitoring

There are wider benefits associated with reducing cash handling. First, digital payments leave behind transaction records, which help tax authorities track income more accurately.

When sellers receive money through bank accounts, it becomes harder to hide sales. That makes it easier for the government to collect taxes and provide better public services.

Another advantage is increased safety. Carrying large amounts of cash exposes individuals to theft or misplacement. By switching to mobile payments or cards, people reduce their physical risk.

Likewise, businesses reduce the need to store money on premises, thereby lowering the chances of armed robbery. Digital records also allow quicker resolution of disputes over payments.

Banks and other financial institutions have gained new data streams through digital transactions. With this information, they can develop credit scores for customers who previously had no formal banking history. Small business owners now find it easier to qualify for loans, since lenders can evaluate their transaction behaviour digitally.

Challenges Faced Along the Way

Despite the progress, certain obstacles remain. One major issue concerns internet access. Many rural communities still experience poor signal strength and lack the infrastructure needed to support regular mobile payments. Although smartphone penetration has improved, data costs remain high in some areas, discouraging consistent use of digital services.

Some people still prefer cash due to concerns over cyber fraud and scams. Trust remains an issue, particularly among the elderly or those unfamiliar with mobile apps. Instances of online fraud have created fear among new users, especially where recovery of stolen funds is uncertain. Cybersecurity measures are improving, but public education on safe digital practices continues to lag.

There are also technical issues. Sometimes, payment platforms experience outages, which disrupt services during important periods like holidays or festivals. Small traders who rely on quick daily turnovers may face difficulties when systems go down. These moments reveal the need for stronger backup mechanisms and faster issue resolution processes.

Government Incentives and Partnerships

To strengthen the move away from cash, authorities have introduced several incentive programmes. Citizens receive subsidies directly into their bank accounts through digital means.

Teens pay for snacks using a mobile wallet at a street vendor (Photo: Alamy)

Farmers, students, and beneficiaries of welfare schemes are now being paid electronically, reducing the scope for delay or corruption. These direct transfers have brought more people into the formal banking system.

Authorities have also worked alongside private companies and startups to reach areas where traditional banks are absent. In some regions, local shop owners now serve as agents, helping customers with withdrawals, deposits, or bill payments. This model of digital banking agents has extended services to underserved populations and encouraged savings among low-income groups.

Educational campaigns have also been organised to teach citizens how to use digital tools. Television, radio, and mobile-based awareness programmes have all been employed to build trust and inform the public. As more people become familiar with how to protect their personal information and avoid fraud, the confidence in digital systems grows gradually.

Impact on Employment and Informal Economy

Digital payments have also brought changes to job markets. Several new roles have emerged, particularly in customer support, tech maintenance, and logistics. Startups offering financial services hire thousands of people in software development, digital marketing, and fraud monitoring. As transactions move online, more data analysts and cybersecurity professionals are required.

On the other hand, informal sectors are undergoing adjustments. Many workers who were paid in cash are now receiving wages through bank transfers. This change brings both benefits and difficulties.

While formal payments help workers gain access to loans or insurance, it also subjects them to income tracking, which some employers try to avoid. This tension between informal and formal methods creates debate in small business environments.

Looking ahead, digital payment systems are likely to become more advanced. Innovations such as facial recognition, biometric verification, and voice-activated commands are being tested to improve convenience and security. These features aim to support elderly users and those with limited literacy levels.

More cities are planning to introduce smart infrastructure that supports cashless living. Parking meters, vending machines, and public toilets are being adapted to accept only digital payments. As public transport changes to app-based ticketing and as more government services are delivered online, the gap between digital and physical currency use continues to widen.

Cross-border payments are another area gaining attention. With millions of citizens working overseas and sending money home, platforms that support cheaper and faster international transfers are becoming more relevant. Mobile wallets that connect across borders may redefine how families manage remittances and savings.

The movement toward digital finance has reshaped how millions relate to money. While challenges remain in access, trust, and infrastructure, the momentum continues to grow.

With support from both government and private companies, and with increasing public familiarity, fewer transactions are being completed with physical currency. What once seemed like a bold idea has now become an everyday reality for many.